Why is Premium Audit Necessary?

These audits are necessary because your policy premium was based on estimated payroll amounts and job duty classifications developed with your Farmers® agent at the outset of the policy period. After the policy term is complete, the audit of your payroll records will verify the actual payroll and business operations so your final premium reflects any changes in your operations from initial estimates. In addition, state Workers’ Compensation Bureaus also expect us to conduct premium audits on all Workers’ Compensation policies.

Note: Your participation is essential in calculating and confirming the final premium and avoiding possible non-compliant audit charges.

The Audit process

At the end of each policy term, we will send you a reminder notice that an audit needs to be conducted. Shortly thereafter you will receive another letter from an auditor acting on behalf of Farmers Insurance® letting you know whether your audit will be self-reported, or will be a physical field audit. These audit types are further explained below. Additional information to help you prepare for your audit, including a checklist of items you may need to provide, can be found on our “Helpful Hints” pages.

Regardless of the type of audit performed, once complete information is provided the auditor will reconcile it and produce an audit which will be forwarded to Farmers®. Farmers’ Premium Audit team will process the audit and your policy will be updated with the most current information reflected. Shortly thereafter, you will receive a Premium Audit Statement with the finalized premium calculation for the audited term showing either a credit due to you, or adjusted premium that is due to Farmers. It is unusual to have the estimated premium reflect the final adjusted premium, but that can happen as well, and then a “0” would be reflected.

Types of Audits

All audits are mandatory.

Self-Reported Audits

Depending on the premium size or type of business, you may be able to participate in a self-reported audit. For this type of audit, you will be sent the information you need to complete your audit through an online website. Specifically, you will be provided with a link, sign on information and password to our website so that you can provide the requested documents and information on-line. You will be asked for payroll records, job duties, and other records to complete your audit. For the payroll records, you will be asked to submit a payroll summary showing gross wages and any applicable deductions for the policy term. In addition, you will be asked to provide records to help verify your payroll summary in the form of the Federal Government payroll reporting forms (941)s or state payroll reporting form state unemployment insurance (SUI) (collectively, verification records). All of this information will be reviewed by an auditor and the audit finalized.

Physical Field Audits

A physical field audit (also referred to as a “physical audit”) is an onsite review of your business operation and payroll records. Depending on your premium size, we may be required by the state to conduct your audit as a physical audit.

A physical audit consists of an auditor physically going to your place of business or wherever else you maintain your payroll related business records. The auditor will review your payroll records, ask questions about the business and employee duties so the correct classification codes are being used and that the payroll is accurately separated by class code.

Consequences of not cooperating with the audit process

When an auditor is unable to complete the audit based on a lack of information or no information being provided, an estimated audit will be processed. Generally, this is based on the original estimated payroll information plus the possibility of an additional non-compliant surcharge percentage if the audit is determined to be a non-compliant audit. Additionally, the policy may be referred to the Underwriting department for review and may be set up to non-renew or for a mid-term cancellation. It is important to note that if the risk is Experience Rated, a new Experience Modification will not be promulgated based on an estimated audit.

What can affect your premium?

Sole Proprietor/Partner/Officers

If officers are not correctly identified on the policy; are not correctly excluded on the policy, or inaccurate payroll information was provided for officers, this can affect the amount of your final premium. In addition, most states have established payroll minimums and maximums for officers. If your officer payroll falls below the state minimum or above the state maximum, those set amounts will need to be used instead.

Casual Labor/Temporary Labor/ Leased Employees

Payments to all casual labor/temporary labor/leased employees have to be reported on final audit documents for the audit period.

OCIP/CCIP Jobs

If you have been enrolled in an Owner Controlled Insurance Program (OCIP)/Contractor Controlled Insurance Program (CCIP), we will need the payroll associated with these jobs segmented out from the rest of your payroll in order to exclude those amounts from the final premium calculation. Please separately show payroll for employees who performed work on the OCIP/CCIP covered project, and include gross wages and any allowable deductions. A Certification of Coverage from the OCIP/CCIP administrator needs to be provided showing the project name, owner or general contractor, OCIP/CCIP insurance carrier, policy number and effective dates for workers’ compensation coverage.

Use of Subcontractors/Independent Contractors

Certificates of workers’ compensation insurance and general liability Insurance need to be obtained for every subcontractor you hire during your policy period, and those policies need to reflect coverage during your policy period. This helps insure that proper classification of job costs can be made. If they are not obtained, the subcontractor and their employees may be treated as your employees for premium calculations. Note, in some cases additional validation may be needed to identify independent contractor status.

Scope of Operations

The scope of your operations will help determine the applicable class codes to use when preparing your policy for pricing.

Each state provides base loss cost factors by classification code, and all insurance carriers use these to help calculate premium for workers’ compensation policies.

Your estimated premium will be based on the rates associated with the appropriate classification code(s).

Helpful Hint Details

How to prepare for your audit

For a complete check list of how to prepare for your audit please click on the link below:

View Preparing for Your Premium Audit PDF

- Keep a record of tips for restaurant employees. Your federal reporting records (941’s) should reflect these numbers.

- Construction companies should keep track of the time and payroll for different types of work, especially if you have employees doing more than one type of work during the day.

- Have the appropriate person available during a physical audit to provide the requested documents and to help answer the auditor’s questions.

- If you are using subcontractors, make sure they can provide Workers Compensation and General Liability certificates of insurance.

- Keep your Farmers® agent updated on changes to your business that may impact your workers’ compensation premium, such as if it appears that your actual payroll will be significantly higher or lower than what was originally estimated by you; the operations of your business changes; you add or change business or office locations; or you incorporate your business and have officers who may be eligible to be excluded from coverage. Your agent can assist with making the necessary adjustments to your policy.

- Use accurate job descriptions. The type of work your employees perform is directly related to the amount of premium you pay for your workers’ compensation policy coverage.

- Properly show overtime paid.

- Be able to identify employees who strictly perform clerical office duties; are strictly outside sales; or are strictly drivers.

- Complete the premium audit timely to avoid premium estimate and possible surcharges.

- Audits of accounts with Farmers RealTime Billing® still require exact payroll reported by check dates.

Time Record Requirements for Dual Wage Classifications

California Construction Policyholders Only

In California, some construction and erection operations are divided into two separate classifications based on the employee's hourly wage rate. For instance, workers engaged in the installation of an automatic sprinkler system whose rate of pay is less than $27.00 per hour are assignable to Classification 5185, Automatic Sprinkler Installation - within buildings - less than $27.00. Workers whose rate of pay equals or exceeds $27.00 per hour are assignable to Classification 5186, Automatic Sprinkler Installation - within buildings - equals or exceeds $27.00.

The Department of Industrial Relations (DIR) Industrial Welfare Commission Order No. 16-2001 requires that all construction employers maintain precise records of hours worked each day for each employee, including daily start and stop times. Meal periods during which all operations cease and authorized rest periods need not be recorded. The employer must produce records verifying the number of actual hours worked as well as actual time cards or time sheets that document the daily start and stop times for each employee and in and out times for lunch.

If the employer fails to keep complete and accurate records as provided in this rule, the entire remuneration of the employee will be assigned to the highest rated classification applicable to any part of the work performed by the employee. Payroll may not be divided by means of percentages, averages, estimates, or any basis other than specific time records.

Prevailing Wage

Timecards are not required when a collective bargaining agreement is available which shows the regular wage rate by employee name and job classification.

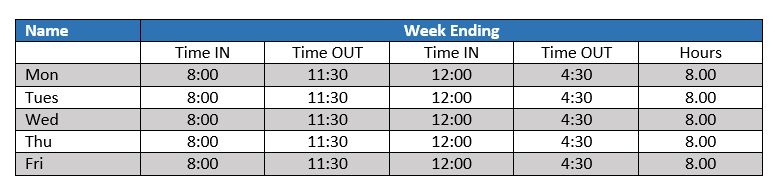

Compliant Time Records Sample

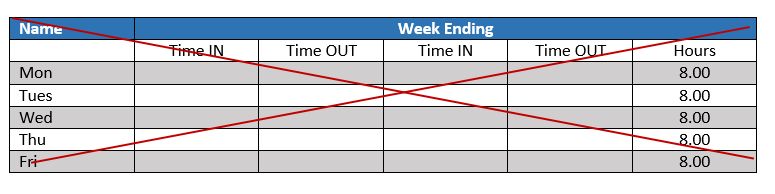

Non-Compliant Time Records Sample

How to calculate overtime pay?

It is important to include the specific and full amount of overtime payroll for each employee when completing your audit. Non-exempt employees may earn overtime pay when they work more than a set number of hours in a work day, or more than a certain number of hours in the week. State and federal laws will determine what triggers overtime pay and what amount it should be.

Overtime remuneration shall be excluded from the premium computation only if:

- The employer’s books and records are maintained so as to show gross overtime pay separately by employee and whether it is regular overtime or double overtime.

Officer Inclusion & Exclusion

The exclusion rules for officers, partners and limited liability company (LLC) members are determined by state law. If the state requirements for exclusion are not met, then the payroll for the officer, partner or LLC member cannot be excluded at the time of audit. Or, in the alternative, if the office, partner or LLC member is eligible to be excluded but did not have themselves specifically excluded on the policy, then their payroll cannot be excluded at the time of the audit. Exclusion of payroll means that there is no Workers Compensation Coverage for that employee. We cannot exclude coverage for an individual unless they are eligible for that exclusion, and they are endorsed as excluded on the policy.

Contractors & Subcontractors

If you are a contractor, or use subcontractors, you must obtain Workers Compensation and General Liability certificates of insurance for all subcontractors hired during the policy period. If the subcontractor does not provide you with a certificate of insurance, showing coverage during your entire policy period, they may be treated as your employee and a premium may be charged for them.

It is to your advantage to obtain proof of insurance from subcontractors and provide copies to the auditor at the time of the audit.

Uninsured subcontractors covered under the principal contractor’s policy are classified on the basis of the classifications that would apply if the work were performed by the principal’s own employees.

What can I do if I don’t agree with my audit?

If you do not agree with the results of your audit or have questions or concerns about it, you may contact your agent so that they can review the auditor’s worksheet with you. Your agent can request the audit worksheets by sending an email to: premiumaudit.coe@farmersinsurance.com. To help streamline the request, agents are encouraged to include the policy number, term dates and the words “audit worksheet request” in the subject line of their email request.

Once you have identified the specific concern with your audit, please complete our Premium Audit Dispute Form and submit it via email to premiumaudit.coe@farmersinsurance.com

Q. My policy is no longer in force, do I still need to do an audit?

A: Yes it is always important to complete your audit, even after you no longer have coverage with Farmers Insurance®. It is important to validate the estimated information provided at the beginning of that policy term. If you do not complete an audit, your audit will be reported to the worker’s compensation rating bureau as an estimated, non-compliant audit. The rating bureau may reach out to you directly to identify the reason for non-compliance. You may also incur an additional audit non-compliance surcharge. If your policy is experience modification rated, that experience modification will not be promulgated by the bureau for the coming year. This lack of an updated experience modification could affect your rates on future workers’ compensation policies.

Q. How are owners treated in an audit?

A: This will depend on how complete of information we receive from the business. We look to the business owner to provide information for each officer, partner, or LLC member, they believe can be excluded or included on the workers’ compensation policy. In addition, due to some state law requirements, we will need to know the ownership percentage(s), job duties, and any salary/compensation for each of them. They will be excluded based on state rules, and how they are reflected on the policy. If they are covered by the policy, their payroll will be included under the class code that represents their job duties. If no payroll is provided, the included officer, partner, or LLC member, will be included at the state determined minimum officer payroll amount. If their payroll exceeds the state maximum payroll, then that officer’s payroll will be capped at that state maximum.

Q. What happens when a business owner doesn’t comply with the audit?

A: First, we hope this will never happen to you. If the business is experience rated, a late audit may negatively affect the promulgation of experience modification factors. Another downside of a non-compliant audit is that it can lead to a surcharge being applied to the estimated premium as well as possibly having the workers’ compensation policy canceled for not complying with the audit requirements of the policy itself. Finding replacement coverage may be more expensive and time-consuming for the business than if they had just complied with the audit.

Q. If I am reporting payroll through Farmers RealTime Billing®, do I still need to complete an audit?

A: Yes, a final premium audit is required on all workers’ compensation policies regardless of the billing plan. Farmers RealTime Billing is a way to identify exposures in a timely manner throughout the policy period and generate a premium based on those identified exposures. The Premium Audit is still needed at the end of the policy term due to state regulations and reporting requirements.

Glossary

Remuneration

Term broadly used to include all payroll and other forms of allowances and benefits such as bonuses, commission, sick days, vacation days, meals and lodging. It also includes cash payments to employees or casual labor.

Classification & Class Code

A statistical code used to categorize the type of work done by your employees in a particular operation.

Source Document

A payroll summary, and or any documents summarizing payroll/remunerations to employees during the audit period.

Verification Document

Verification documents are the documents used to validate the total payroll reported at the time of the audit. These verification documents are the quarterly payroll reporting to both the state and federal level. The federal reports are referred to as the 941’s. The state reports are referred to as the DE9C’s in California, and SUI’s for the rest of the country.