When deciding how much home insurance you want, it’s important to make careful estimates of your needs based on the four main parts of your homeowners insurance policy: dwelling coverage, personal property coverage, liability coverage and additional living expenses coverage.

How much dwelling coverage do I need?

Estimate how much it would cost to rebuild your home if it’s destroyed by a fire or another catastrophe. This figure drives the dwelling coverage part of your home insurance.

The cost of rebuilding isn’t the same as the price you paid for your home, or the mortgage or the home’s market value. For example, the market value of your home includes the land it sits on, which is not factored into rebuilding calculations.

To estimate the cost of rebuilding:

Research building costs in your area. The cost of construction materials and labor varies widely across the country and changes often. Consider asking a reputable contractor, realtor or your insurance agent about the price per square foot of new home construction in your region.

Factor in the age of your home. An older home may have to be rebuilt to modern building code standards, which can add to the cost.

Include the value of renovations and features you’ve added. A kitchen remodel using expensive materials like marble countertops or an addition like a deck should be included in your coverage estimate. It may cost more to replace or rebuild features made with new materials or specialized labor.

Run a replacement cost estimator. Calculating rebuilding costs may prove complicated. A Farmers® agent can run a “replacement cost estimator” that takes the relevant variables you provide into consideration.

How much personal property coverage do I need?

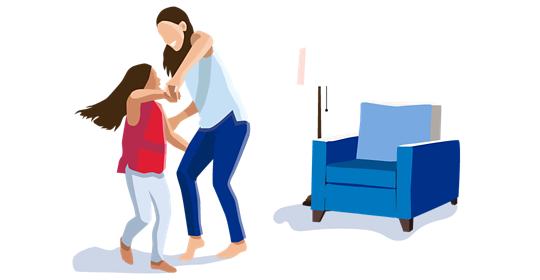

Take a home inventory of your possessions. If these items are stolen, damaged or ruined, the personal property coverage in homeowners insurance helps pay the cost of replacing or repairing them (as long as it’s a covered loss). Learn how to take a home inventory.

This inventory can drive your personal property coverage limit. But take special note of unique or expensive property like jewelry, artwork, antiques and high-end electronics. A standard homeowners insurance policy may cover these items but may provide relatively low limits. (A limit is the highest amount your insurer will pay for a claim that your policy covers.)

If you own items like these, talk to your Farmers agent about adding personal property “floaters” — extra coverage that insures your individual valuables at limits above what your main homeowners policy can deliver.

How much liability coverage do I need?

This depends on your assets, meaning the combined value of your home, bank accounts, investments, other property and anything else of value you own. To determine how much liability coverage you may want, it’s important to add up your net worth and see what liability coverage limits would be enough to cover that amount.

If you are sued and found responsible for an injury or property damage, for example, this coverage can help pay for medical costs, repairs or replacement of damaged property, and legal costs — but only up to the coverage limits you choose.

You can also add a separate umbrella policy, which adds liability limits above those provided by your homeowners insurance and car insurance policies.

How much additional living expenses coverage do I need?

Calculate what it would take to house yourself and your family if your home is ever damaged so badly you cannot live there while it is being rebuilt or repaired. Research rents in your area for a similar residence in a convenient location. Add in your grocery bills, transportation and other per-month costs. How much of that amount is above your normal living expenses? The answer may give you a ballpark idea of how much coverage you may want.

Learn From Experience

Read more about home insurance coverage.

Why Did My Homeowners Insurance Go Up?

First, it’s important to know insurance premiums are calculated based on two major factors: your overall risk and the cost to replace your home. When outside forces — think: inflation, natural disasters, supply chain issues, rising construction costs — impact either (or both) of those factors, it can explain why rates may be increasing. But there are steps you can take to help keep your costs down.

Does Home Insurance Cover My Foundation?

Whether foundation repairs are covered depends on the source of the damage. Every part of your home, including the foundation, is subject to wear and tear over the years.

Is Home Insurance Required If I Own a Home?

Home insurance isn’t required by law, but there are other reasons to insure your home. If you have a mortgage on it, your lender will require you to have insurance until the loan is paid off.